Capital gains tax calculator on sale of property 2021

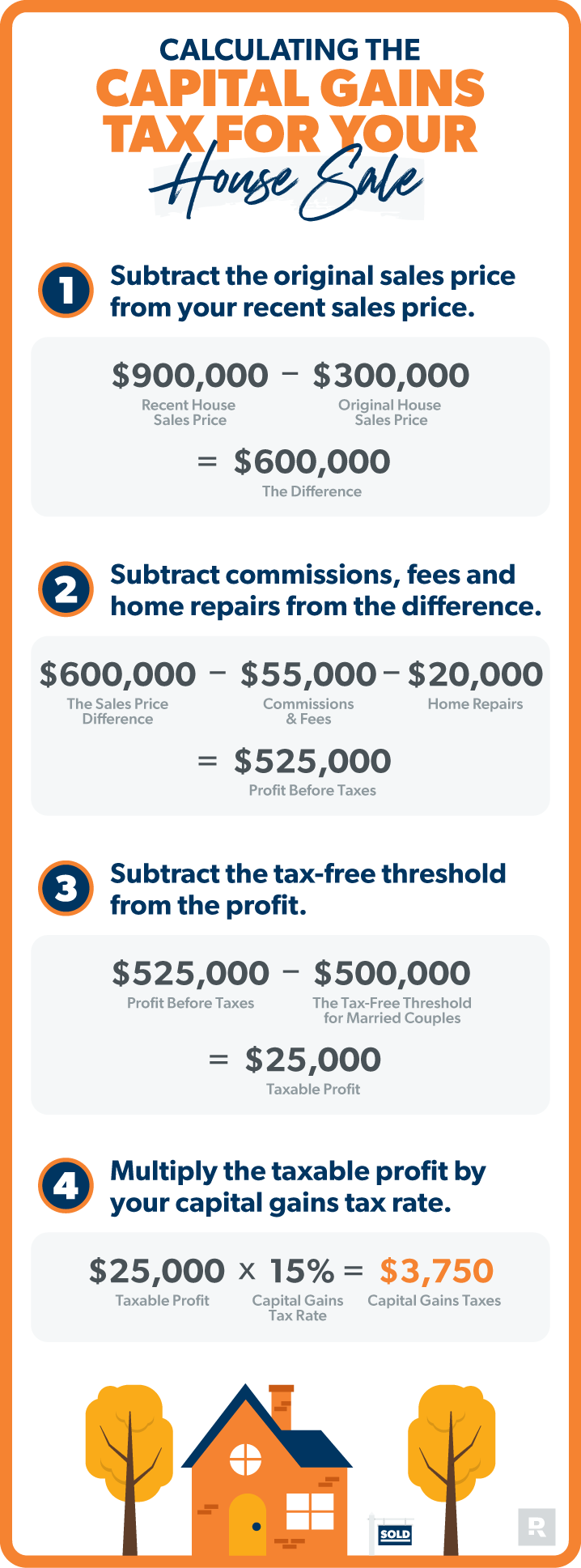

Essentially your capital gain is the difference between the cost of your property and the sale price or market valuation when gifting or selling to friends and family. You can also claim capital losses when you have capital gains.

Capital Gains Tax Calculator 2022 Casaplorer

In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D.

. As for the other states capital gains tax rates are as follows. Further you can also file TDS returns generate Form-16 use our Tax Calculator. So if you sell your.

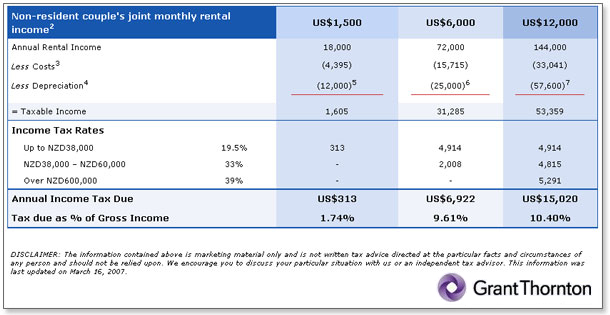

However theyll pay 15 percent on capital gains if their income is. However in order to enjoy the exemption the capital gains on the sale of the property must not exceed Rs2 crore. Capital gains tax on shares Capital gains tax on shares is charged at 10 or 20 depending on your income tax band.

Under Section 54 if you sell a property and reinvest the money in another property by buying or constructing at least two houses then you will be exempted from paying the capital gain tax. This guide shows you how to calculate your bill. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property.

See terms and conditions for details. The tax rate on capital gains from the sale of collectibles such as coins or art is 28. The best way to accurately calculate your capital gain is to keep accurate and detailed records.

What You Should Report to the IRS. Capital Gains Tax. Regarding capital gains on inherited property and losses you can claim a capital loss on inherited property if you sold it and all of these are true.

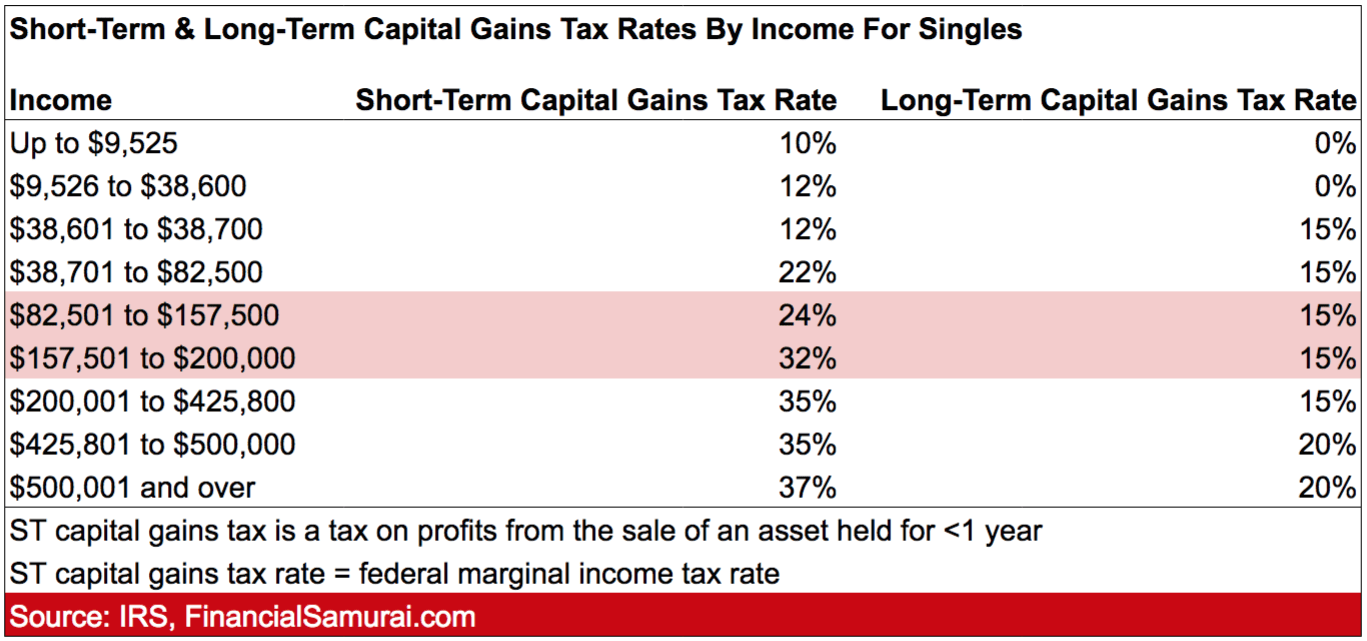

Garage Sale Money and Capital Gains. Short-term capital gains tax rates are generally higher than long-term capital gains tax rates. Claiming capital losses.

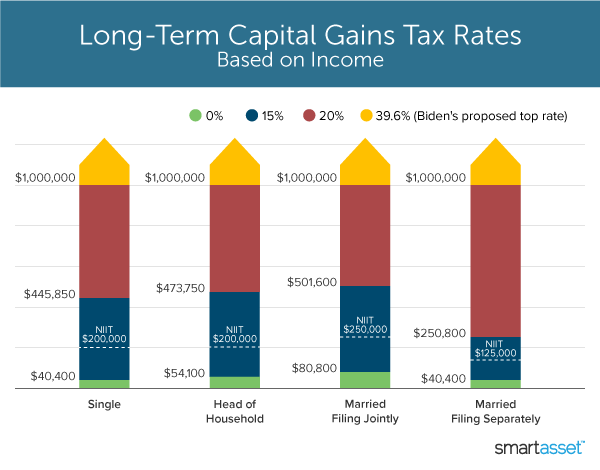

According to the IRS the average taxpayer will probably fall into the 15 capital gains tax bracket. This exclusion is for home sellers who lived at their property as their primary residence for at least two years before the sale. For long term capital gains tax.

Any profit or gain that arises from the sale of a capital asset is a capital gain. The IRS taxes unrecaptured Section 1250 gains at a rate of 25. Capital gains on the sale of a property There are many misconceptions about capital gains tax in Canada including the belief that all gains are taxed at a rate of 50.

Long-term capital gains can apply a deduction of 30 or 60 for capital gains from the sale of farm assets. Short-Term Capital Gains Tax Rates 2022 and 2021. HR Block Maine License Number.

Capital Gains Tax Rates in Other States. If you have 50000 in long-term gains from the sale of one stock but 20000 in long-term losses from the sale of another then you may only be taxed on 30000 worth of long-term capital gains. Heres a closer look at long-term capital gains tax rates for 2021 according to Kiplinger.

You Might be Interested in. September 1 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. Capital Gain Tax Rates.

The IRS uses ordinary income tax rates to tax capital gains. More help with capital gains calculations and tax rates. 2021 HRB Tax Group Inc.

Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real. Capital losses from investmentsbut not from the sale of personal propertycan typically be used to offset capital gains.

The capital gains tax rate reaches 765. Capital Gains on Depreciated Property. Find out how much CGT youll pay.

This revenue is then used to fund government programs and spending. So why does capital gains tax exist. The tax rate on most net capital gain is no higher than 15 for most individuals.

The IRS assesses capital gains tax as a means of raising revenue for the government. Investors must pay capital gains tax on stocks bonds and other investments when they earn a profit. It calculates both Long Term and Short Term capital gains and associated taxes.

12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Wisconsin taxes capital gains as income.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Capital gains tax CGT is payable on the sale of second homes and buy-to-let property. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

Capital Gains Tax Calculator Values. 2021-2022 Capital Gains Tax Rates. Sourced from the Australian Tax Office.

So if you have assets not limited to property that you earned income on you can lower your gains by. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. That being said capital gains rates can run as high as 20 on real estate transactions.

There is option to include cost of repairsimprovement that you might. Capital Gains Tax CGT Calculator 2021 How Much Do You Pay. This is done to encourage investors to hold investments for a longer period of time.

You need to feed your property sale purchase date along with values. Capital losses from the sale of personal property arent deductible. For 2022 and 2021 the long-term capital gains rates are as follows.

Long-term capital gains on sale of house property is taxable at the rate of 20 flat on the quantum of gains made. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower. For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any.

Special capital gains tax rules. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Under law anyone can exclude up to 250000 of capital gains or 500000 for a married couple filing a joint return after the sale of a property.

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Property Tax Calculator Deals 56 Off Www Ingeniovirtual Com

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Tax Calculator For Rental Property Best Sale 50 Off Www Ingeniovirtual Com

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Capital Gain Tax Calculator 2022 2021

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

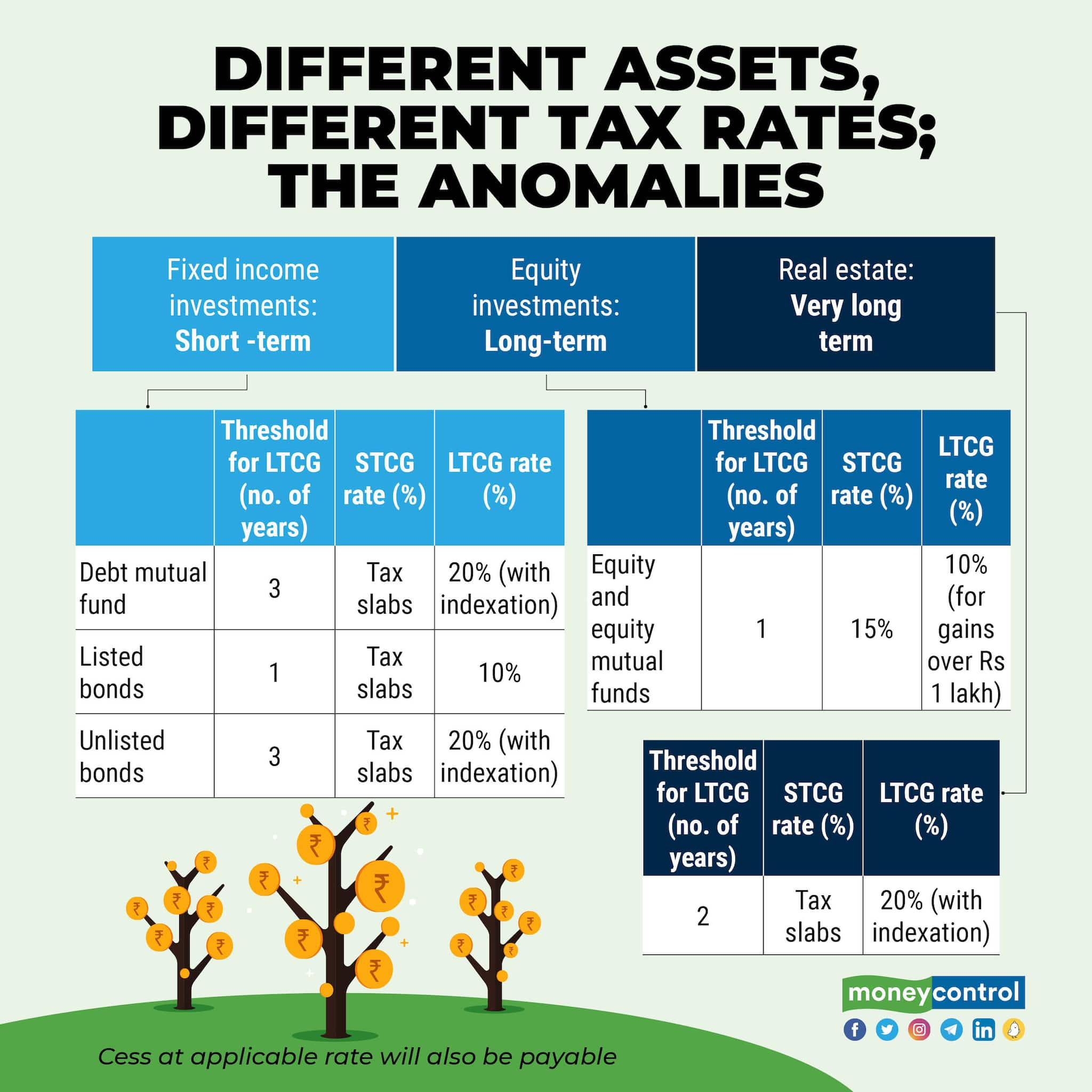

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

Capital Gains Tax On Sale Of Property Long Term 2020 21 Moneychai

Income Types Not Subject To Social Security Tax Earn More Efficiently

2022 Capital Gains Tax Rates By State Smartasset

Karamel Sonsuzluk Anlasmazlik Short Term Capital Gains Tax Calculator Dgfrn Bj Org

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

Karamel Sonsuzluk Anlasmazlik Short Term Capital Gains Tax Calculator Dgfrn Bj Org

3 Simple Methods How To Calculate Capital Gains Tax And Concessions You Can Take Advantage Of Box Advisory Services

How Are Dividends Taxed Overview 2021 Tax Rates Examples